Mergers and Acquisitions: A Year in Review of 2022

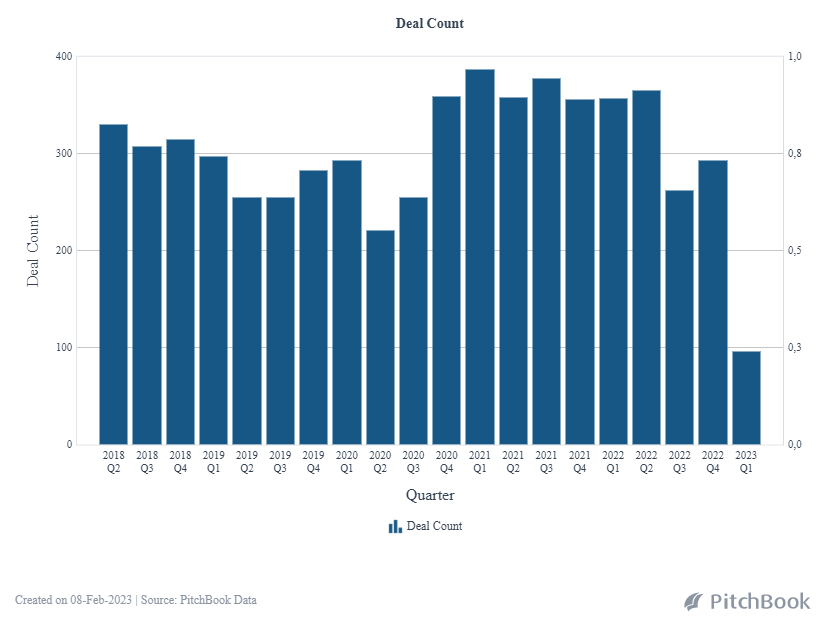

Following all-time high records of deal activity and valuations across several different market sectors and asset classes in 2021, 2022 in many respects represented a sharp correction, especially in public equity markets and cryptocurrencies. Overall, M&A deal activity in the Canadian lower-middle market remained robust in 2022, though there was a noticeable shift in buyer and seller expectations partway through the year, which impacted dealmaking.

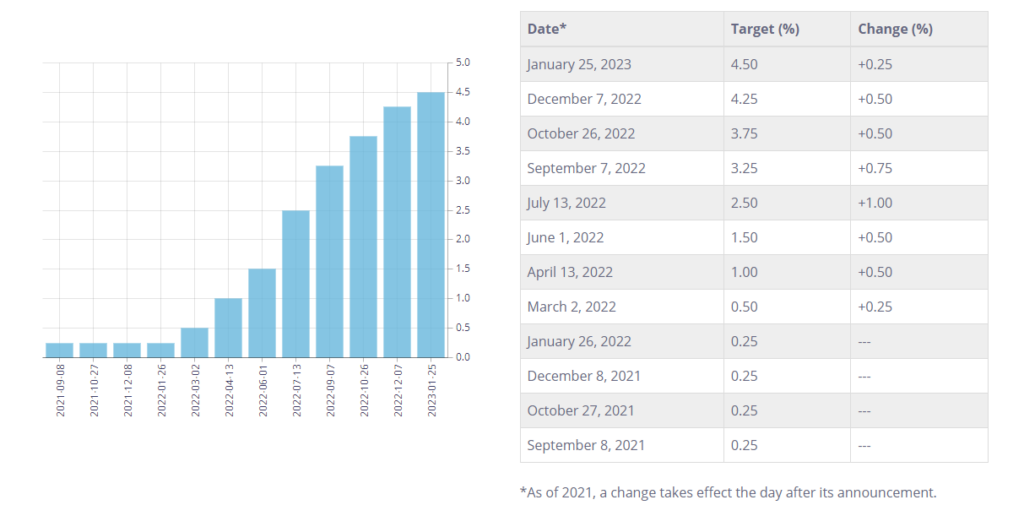

In the first half of 2022, deal activity and valuations remained strong, building off the momentum of a record year in 2021. In the latter half, however, we observed a shifting sentiment towards caution as businesses faced a series of challenges carrying over from 2021, such as rampant inflation, labour shortages, and supply chain constraints, followed by monetary tightening in response, and the global impact of the Russia–Ukraine war in 2022. Inflation, which increased from 4.8% at the end of 2021 to a peak of 8.13% in June 2022, added to the confusion over valuation expectations between buyers and sellers, as many businesses experienced higher profitability with revenues increasing earlier than expenses due to inflation. In contrast to the historically low-interest-rate environment of 0.25% that it had maintained since 2020, the Bank of Canada sought to curb steep inflation with seven overnight interest rate hikes in 2022, settling at 4.25%. Logic dictates, therefore, that this rising cost of debt would negatively impact valuations.

Towards the latter part of 2022, there was growing chatter about an inevitable recession looming on the horizon and the impact the increased cost of capital would have.

Representing both buyers and sellers, Smythe advised on 17 successful transactions in 2022, across a range of industries. For our clients running recession-resilient businesses (such as distributors of consumables used in diversified industries or P&C insurance brokerages), valuations remained strong and, in some cases, even continued to rise through 2022. We credit this dynamic to a relatively robust pool of capital chasing fewer deals.

For our clients operating in industries that are more sensitive to an economic downcycle (e.g., those that rely on discretionary spending), some decided to pause their succession planning until there was more confidence in the market. However, for those clients that decided to proceed with a transaction process, we observed either fewer offers, lower valuations, or more sizeable vendor financing or earn-outs, as many buyers quickly adapted to the uncertain economic environment and were generally more pessimistic about the medium-term outlook of these sectors.

2023 Outlook

Entering 2023, we don’t expect valuations and deal activity to return to 2021 levels in the near term. We do, however, expect M&A activity to remain just as active across recession-resilient sectors. For shareholders of businesses operating in industries more significantly impacted by a recession-like environment, we expect two scenarios:

- If they are motivated to sell, they will move forward with a transaction process and find ways to bridge valuation gaps; or

- they will decide to wait until there is renewed optimism, as the valuations under these circumstances might no longer result in the payday they need to fund their lifestyle through retirement. As the “Baby Boomer” generation approaches their 70s, our assumption is that the cost of time spent waiting to sell might outweigh the benefit.

We expect that whether businesses are recession-resilient or sensitive, purchasers will be more selective of the acquisition opportunities they pursue and will likely apply more scrutiny in their due diligence processes. This will result in fewer offers at the high end of an expected valuation range, and will mark the dawn of a more “buyer friendly” market. In addition, we will likely see more term sheets with earn-outs or vendor financing to bridge valuation or financing gaps.

From a lending perspective, the general consensus is that the Bank of Canada will slow down its interest rate increases in 2023 to allow time for the market to adjust to the rapid rate hikes in 2022. The higher cost of financing will make acquisitions more challenging, especially for those buyers relying heavily on leverage. This might prove to be an advantage to strategic purchasers, as they are less sensitive to achieving internal rate of return (IRR) targets relative to traditional private equity purchasers.

In effort to self-fund growth strategies or focus operations, corporations might evaluate low-performing or off-strategy divisions of their business to determine whether spinoffs or carveouts are in the best interest of the company in the long term.

Conclusion

As noted above, we expect that M&A activity will continue to be strong in 2023. For those that are pausing their divestiture or acquisition plans, we recommend they reflect on their strategic or succession planning goals in order to put themselves in the best position to realize value. If you are looking to purchase or sell a business or would like to discuss the observations made within this article, please contact a member of our team.

Reach Out

Our Work Select Transactions

Optimum Strategies Inc. Acquired by Navacord Corp.

Smythe Advisory acted as the exclusive divestiture and tax advisors to Optimum Strategies Inc., a B.C.-based brokerage that specializes in providing group benefits and private health service plans, in its sale to Navacord Corp.

Shephard Ashmore Insurance Inc. Acquired by Westland Insurance Group Ltd.

Smythe Advisory acted as the exclusive divestiture advisors to Shephard Ashmore Insurance Inc., one of Canada’s leading music and entertainment specialty insurance brokerages, in its sale to Westland Insurance Group Ltd.

Bedrock Insurance Brokers Inc. Acquired by Axis Insurance Managers Inc.

Smythe Advisory acted as the exclusive divestiture advisors to Bedrock Insurance Brokers Inc, a North York, Ontario based commercial lines focused insurance brokerage, in its sale to Axis Insurance Managers Inc