Careers

At Smythe, we believe strongly in celebrating your efforts and investing in your growth as a professional. Our successes over the last several decades are a product of our talented and dedicated employees. We are always looking to add new faces and skills to our team of professionals.

Join Our Team

Whether you are a student at the beginning of your career or an experienced professional, there is a place for you at Smythe. We always are looking for energetic and dedicated people to add to our team. At Smythe you will work with a team of professionals committed to making a difference and having fun along the way.

Campus Recruitment

Begin your career at Smythe where you have many opportunities to grow into an accounting professional. Our student opportunities are designed to help you learn on the job in a dynamic and fun workplace.

Experienced Recruitment

Experience the Smythe difference. Our opportunities for experienced professionals provide you with an environment where your skills and expertise shine and are appreciated.

Life at Smythe

Smythe is pleased to offer additional perks that go beyond the standard Benefits Plan. Check out some of the highlights below:

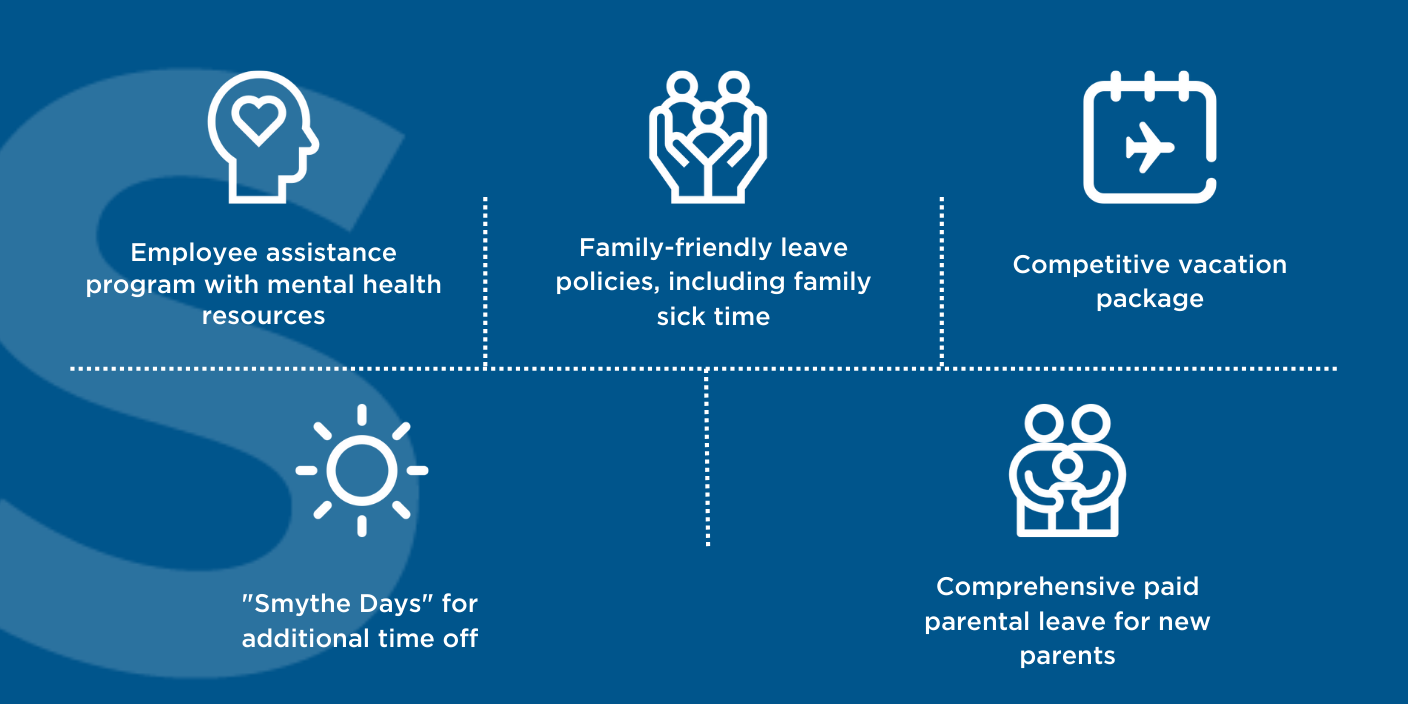

At Smythe, we value our employees’ mental health and work-life balance. Team members are allowed to take personal and vacation days as it suits them. Smythe also offers “Smythe Days” that consist of firm-wide office closures over summer and winter holidays where employees are given a bonus day off to relax and recharge. Employees can also opt for voluntary banked overtime, should they desire.

Employees also have access to numerous services and resources including our robust employee and family assistance program with Homewood Health, to provide in-person consultations and a full range of expert health and wellness tools and resources.

Our Wellness Committee promotes resources and activities that boost employees’ health and wellness, and our Betterment Brigade coordinates initiatives around sustainability and giving back, to ensure we do our part as members of the society and communities we live and work in.

Being a mid-sized firm with over 200 employees, there are plenty of opportunities available to all team members to socialize and network. We have several active committees including a Social Committee that regularly coordinates firm-wide social events, such Afternoon Socials and various holiday parties.

Smythe also offers flexibility in working through our hybrid work arrangement. To allow for effective collaboration, staff are encouraged to be physically present at the office or at the client’s site for a minimum of two days a week. For the remaining workdays, Smythe offers staff the flexibility of working where they would like – whether from home, their primary office, or one of our other office locations.

Smythe is extremely proud of our ongoing partnership with our hometown team, the Vancouver Canucks, and we endeavour to support the team as much as we can every season.

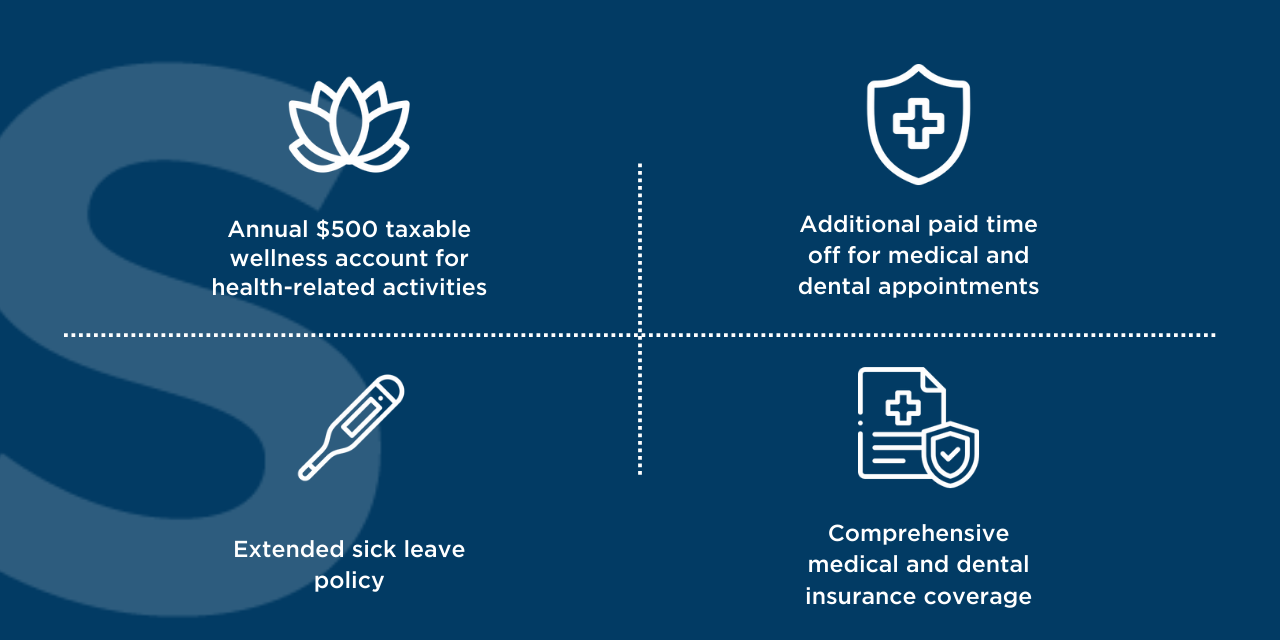

Smythe offers all employees access to an annual $500 Taxable Wellness Account, which covers personal health and well-being activities or equipment such as gym equipment, lift tickets or transit passes.

Smythe also provides comprehensive medical and dental benefit plans. Employees are entitled to paid time off for medical and dental appointments, sick leave, as well as short and long term disability plans.

We also have various recreational and intramural activities throughout the year. For the last several years, Smythe has sponsored a Sun Run team with training runs throughout the spring. We also host regular Wellness Walks for staff to participate in during their lunch break. Over the years, Smythe has seen many successful sports teams including the Hit Squad slow pitch team and a dodgeball team. All of our sports teams are championed by staff members – the sky is the limit!

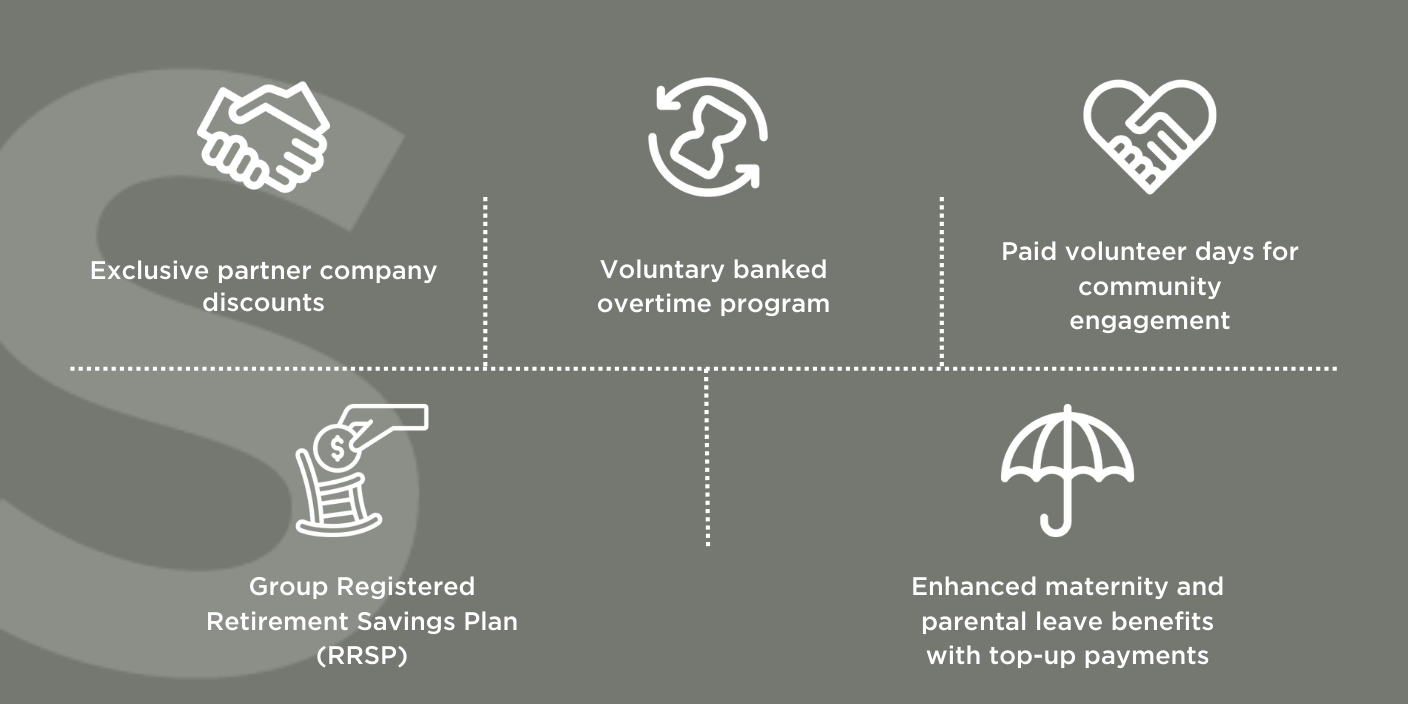

At Smythe, we offer exclusive discounts with partner companies to help stretch your budget further. Our voluntary banked overtime program provides flexibility in managing work hours. Additionally, we encourage community engagement through our paid volunteer days program, allowing employees to give back to causes they care about while representing Smythe.

We also care about assisting our employees financially for key life events. In order to assist employees in saving towards their future goals, Smythe offers a Group Registered Retirement Savings Plan (RRSP). In addition, Smythe supports our employees as they grow their families by offering employees maternity and parental leave benefits under Employment Insurance with “top-up” payments.

Recognized as BC and Canada’s Best

Smythe has been recognized as one of BC’s Top Employers and one of Canada’s Top Small and Medium Employers for 2024, highlighting our commitment to professional development, flexible work arrangements, and exceptional workplace culture. Click the link below to learn more.

read moreOur Guiding Principles Values

Collaboration

We know that teamwork, respect and open communication are the keys to our success.

Rewarding

We provide fulfilling career opportunities and professional development while prioritizing a healthy work-life balance.

Excellence

We are passionate about what we do and always put our best foot forward for our clients.

Progressive

We know that our strength lies in our differences, and we always plan with an eye on the future.

Empowerment

We empower our clients and our team through trust and by providing them a platform to think outside the box.

Want to learn more about Smythe?

About Us

Opportunities Await

Smythe LLP is a leading professional services firm with locations in Vancouver, Langley and Nanaimo. Since 1980, we have been providing assurance, taxation, and business advice to private and public clients across BC and Canada, empowering them to grow and thrive.

Want to work at Smythe, but don’t see the perfect opportunity? We would still love to hear from you. Email us at careers@smythecpa.com

Current Opportunities