Mergers and Acquisitions: 2024 Year in Review

A Look Back at Our 2023 Predictions

Heading into 2024, we expressed cautious optimism about the M&A landscape. The expectation of interest rate cuts during the year led us to anticipate a rebound in deal activity compared to 2023. However, we also acknowledged that economic uncertainty would sustain a buyer-friendly market, where selectivity remained high.

We also believed that quality businesses would see valuations recover, while those that were off-strategy for investors would struggle to attract interest. Additionally, we expected B2B businesses to drive deal flow, while B2C businesses would face headwinds as consumers continued to grapple with cost-of-living pressures.

2024 in Review: Key Trends and Observations

Smythe advised on 18 transactions in 2024 with enterprise values ranging from $2 million to $300 million, representing both buyers and sellers across a range of industries. Several key trends emerged from our deal activity:

- Resilient Revenue Models in Demand – Companies with recurring revenue models remained highly sought after. The predictability and stability of cash flows continued to be a key factor in valuation premiums, as investors looked for businesses with built-in resiliency.

- Increased Use of Earn-Outs and Vendor Take-Backs (VTBs) – for transactions involving the acquisition of a business having “resilient revenue”, we observed strong demand and minimal deferred consideration. For businesses in more vulnerable or cyclical economic/industrial cycles, given uncertainty in the market, we observed more earn-outs or VTBs than in previous years. Buyers were looking for ways to mitigate risk, while motivated sellers had to align with these structures to achieve desired valuations.

- Extended Closing Timeline – similarly, for businesses with “resilient revenues”, although we observed increased intensity of due diligence, we did not see a material change in the length of time it took to complete transactions. Compared to pre-2023, acquisitions of businesses in cyclical industries took longer to close. Some reasons included delays in lender financing, increased due diligence efforts, and increased patience to review the ongoing business performance of the target relative to vendor forecasts.

- Premium Valuations for Quality Businesses – The bifurcation in valuations persisted, with high-quality businesses continuing to command strong multiples, while weaker businesses within the same industry struggled to generate interest or required creative deal structures to get transactions across the finish line.

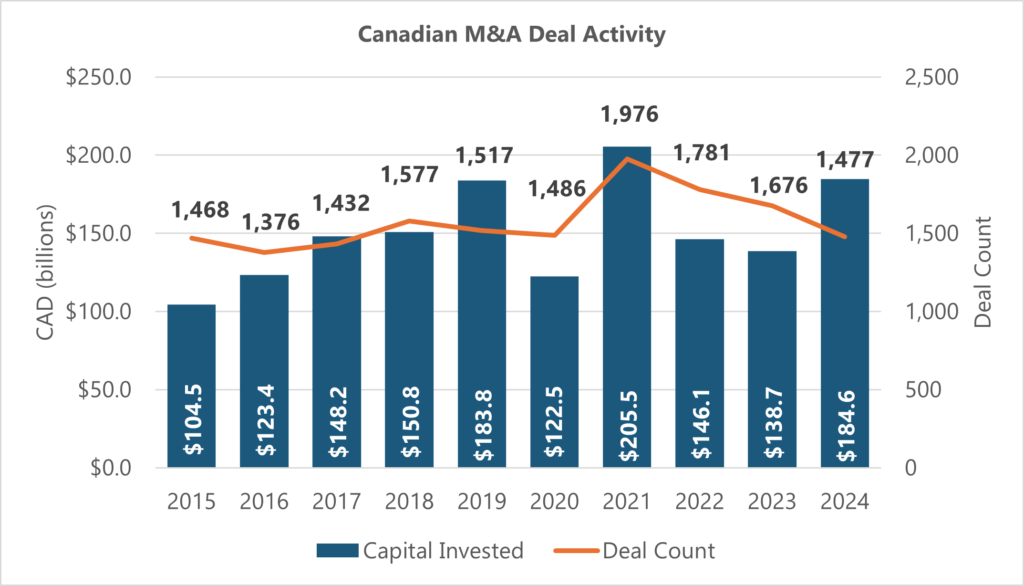

The trends that we observed are consistent with the data that we have seen on the general Canadian M&A market as outlined in the charts below. While deal volume in 2024 was at a seven-year low, it was comparable to pre-COVID levels..

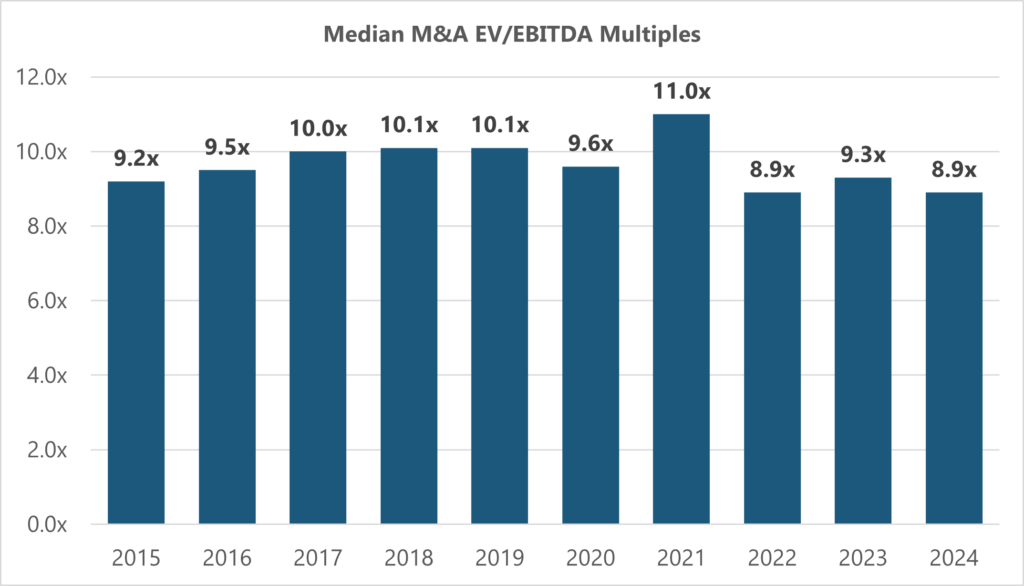

Median EV/EBITDA multiples declined slightly relative to the peak multiples observed in 2021.

Outlook for 2025

Looking ahead, we anticipate a continuation of the trends we observed in 2024. Economic and political uncertainty, including tariff-related concerns, will likely keep a cautious tone in the market. While quality businesses will continue to attract premium valuations, others may need to adjust expectations or structure deals creatively to get transactions completed.

As we move into 2025, we remain focused on helping our clients navigate this evolving landscape, leveraging our experience to execute transactions that align with their strategic goals.

Reach Out

Our Work Select Transactions

Jim Kelly Insurance Brokers Acquired by Stoneridge Insurance Brokers

Smythe Advisory acted as the exclusive divestiture advisors to Jim Kelly Insurance Brokers, an Ontario-based insurance brokerage providing personalized insurance solutions and risk management services for individuals and businesses, in its sale to Stoneridge Insurance Brokers.

Western Associated Insurance Brokers Ltd. Acquired by AMC Insurance Service

Smythe Advisory acted as the exclusive divestiture advisors to Western Associated Insurance Brokers Ltd., a Vancouver-based property and casualty insurance brokerage providing insurance brokering services to B.C. based commercial and personal lines clients, in its sale to AMC Insurance Service.

Baker Insurance Acquired by Axis Insurance Managers Inc.

Smythe Advisory acted as the exclusive divestiture advisors to Baker Insurance, a Calgary-based property and casualty insurance brokerage providing risk management and insurance brokering services to businesses and high-net-worth private clients, in its sale to Axis Insurance Managers Inc.