Mergers and Acquisitions: 2025 Year in Review

A Look Back at Our 2024 Predictions

Heading into 2025, we expected a selective market, with buyers taking measured decisions rather than rushing to close deals. While interest rates were improving, we anticipated that economic and political uncertainty, particularly tariff and trade-related concerns, would keep buyers cautious and disciplined. As a result, we expected that well-positioned businesses would continue to command premium outcomes, while others would require flexibility on pricing and structure to complete a transaction.

2025 in Review: Key Observations from Our Deal Activity

In 2025, Smythe represented both buyers and sellers on 11 completed transactions with enterprise values ranging from $4 million to $75 million. All transactions involved industry buyers backed by financial investors and private equity. Based on this activity, several patterns emerged:

Buyer demand concentrated around a small number of businesses

Buyer interest in 2025 was heavily concentrated, with a small number of businesses attracting a large share of attention as buyers looked for stability amid economic uncertainty. These businesses typically shared several characteristics: recurring revenue, sustained double-digit growth over multiple years, improving margins, strong internal systems, and management teams willing to stay on after the sale and reinvest alongside the buyer.

As a result, these transactions moved forward more quickly. The diligence process was narrower, timelines were shorter, and fewer issues needed to be resolved before closing.

For most businesses, diligence took longer and payment terms mattered more

For businesses outside this top tier, buyers generally spent more time reviewing the business before committing. This was driven by uncertainty around future performance and external factors such as tariffs and economic pressures on growth.

While we did not see transactions fail due to tariff concerns, buyers took more time to understand potential impacts and often tied a portion of the purchase price to future results. These approaches allowed deals to move forward, but typically required longer timelines and more negotiations.

As processes stretched out, deal fatigue became a real factor. We saw multiple situations where sellers chose to walk away because the process felt drawn out and emotionally exhausting. When momentum slowed, both sides were more likely to reassess whether continuing made sense.

Industry buyers backed by financial investors dominated completed transactions

All of our closed transactions in 2025 involved established companies buying to grow, supported by financial investors. These buyers had access to capital and a clear mandate to grow through acquisitions.

This supported deal activity even in a cautious market, particularly where buyers could clearly see how the business would fit into their existing operations.

Fit mattered as much as price

Buyers placed significant weight on strategic fit. Even when a business performed well financially, buyers were reluctant to pursue opportunities that did not match how they wanted to grow, where they wanted to operate, or how they already ran their businesses.

With limited time and many competing priorities, buyers focused on opportunities that clearly fit their plans. Potential buyers often passed on opportunities that weren’t a strong fit, even if the price represented a “good deal”, showing that fit mattered more than the price.

Businesses with uneven results faced more challenges

Businesses with highly variable revenue and earnings, particularly those dependent on project-based work, were less attractive. Given ongoing economic uncertainty, buyers were cautious about taking on businesses where future results were difficult to predict.

This did not eliminate buyer interest, but this is where the strategic fit became even more critical. Unless the opportunity fit strategic needs, potential buyers did not pursue the opportunity. For ones that did proceed, earnouts were used to address the uncertainty.

Growing interest in management buyouts

We saw increased interest in management buyouts as owners explored internal succession options. While appealing in concept, these transactions were often difficult to complete. Management teams frequently do not have access to enough upfront financing. As a result, these transactions faced a gap between what the owner believed the business was worth and what management could realistically afford, requiring more time or revised expectations to move forward. For businesses where there is a desire for the ownership to be widely held amongst the employees, employee-ownership trusts are being explored to bridge the gap in after-tax proceeds.

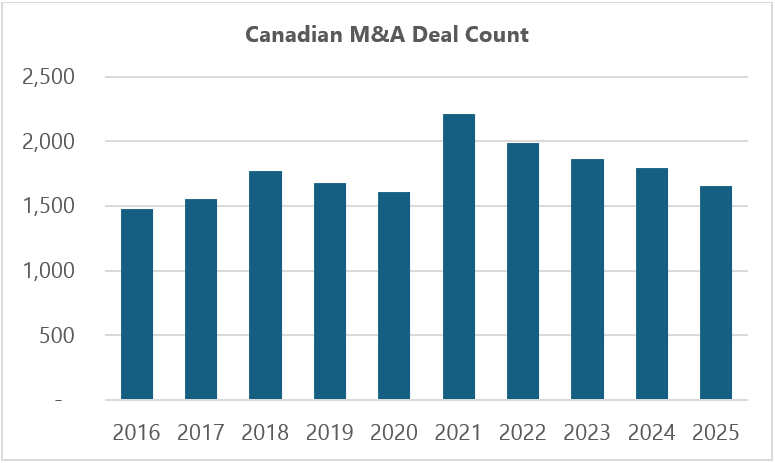

The trends that we observed are consistent with the data that we have seen on the general Canadian small and mid-market M&A deals as outlined in the charts below. While deal activity in 2025 was lower than the peak in 2021, it was comparable to pre-covid levels.

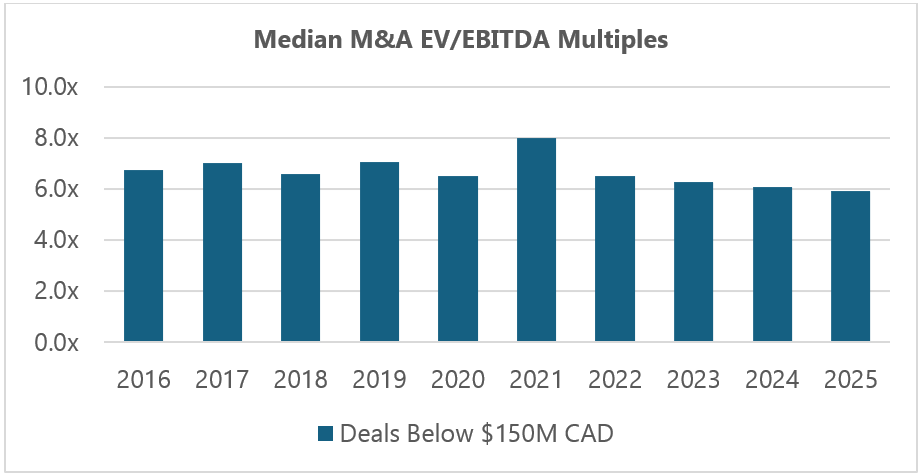

Median EV/EBITDA multiples for small and mid-market M&A deals are in line with the past few years but relative to the peak multiples observed in 2021 and pre-covid levels, the multiples are lower.

Outlook for 2026

We do not expect a dramatic shift in market dynamics in 2026. Buyers will continue to be active, but selective, and the gap between businesses that attract quick interest and those that require longer processes is unlikely to narrow.

For owners considering a transaction, the key question will be whether the business fits what those buyers are prepared to pursue today. Strategic fit and business fundamentals will continue to influence outcomes as much as price.

As we move into 2026, our role remains focused on helping owners evaluate readiness, manage process risk, and execute transactions with a clear understanding of what the market will support.

Reach Out

Our Blogs Read Our Recent M&A Blogs

Our Work Select Transactions

Pemberton Insurance Brokers Acquired by Acera Insurance

Smythe Advisory acted as the exclusive divestiture advisors to Pemberton Insurance Brokers, in the sale to Acera Insurance. Pemberton Insurance Brokers is a full-service insurance brokerage in BC, providing commercial and personal coverage solutions to clients across diverse industries.

Brownridge & Company Insurance Services Inc. Acquired by Navacord Corp.

Smythe Advisory acted as the exclusive divestiture advisors to Brownridge & Company Insurance Inc. in its sale to Navacord Corp. Brownridge Insurance is a leading commercial property and casualty brokerage in Northern BC, serving a broad range of clients and industries.

Staples & Company Employee Benefits Consultants Inc. Acquired by People Corporation

Smythe Advisory acted as the transaction and tax advisors to Staples & Company Employee Benefits Consultants Inc., in its sale to People Corporation.