Canadian M&A Market Update

Canadian insurance brokerage M&A activity has exhibited a consistent upward trend for the past decade, Mergers and Acquisition (M&A) activity for insurance brokerages in Canada ended on a strong note in the last quarter of 2024. We observed several shifts in acquirer and market sentiment against a backdrop of political uncertainty. Regardless, we feel the stage is set for continued consolidation in 2025, with acquisition multiples remaining elevated, albeit unevenly distributed across the brokerage spectrum.

Overall Activity

There were 20 publicly announced Canadian M&A transactions in Q4, which is on par with the number of closed deals announced in Q4 of the last three years. This brought the total number of publicly announced M&A transactions for 2024 to 82, down from 116 in 2023. M&A activity in the first half of 2024 was at a rapid pace, much of which was driven by the anticipated increase in capital gains inclusion rates on June 25th, 2024 (now not expected to come to fruition). However, there was a marked slowdown in Q3 relative to the previous three years, bringing down total deal activity.

Our view is that 2022-2023 were outlier years in terms of the number of completed transactions, and that the number of transactions in 2024 is within range or higher than pre-pandemic years. Peaks and valleys are expected going forward; however, demand remains robust for 2025, and as a result, we expect valuations to remain elevated for quality brokerages.

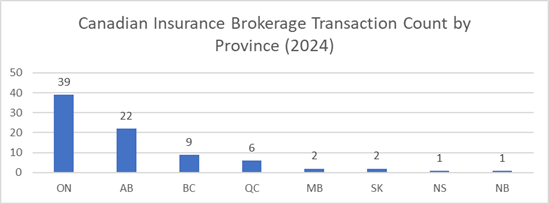

Geography

Ontario and Alberta continue to represent the largest proportion of M&A activity in Canada in 2024 as in previous years. The demand for retail brokerages in provinces with public auto insurance remains weaker, with exceptions made for brokerages with a strong commercial book of business or scale. With that being said, we’ve observed increased interest in B.C. as ICBC commissions have recovered to levels prior to the switch to the no-fault model.

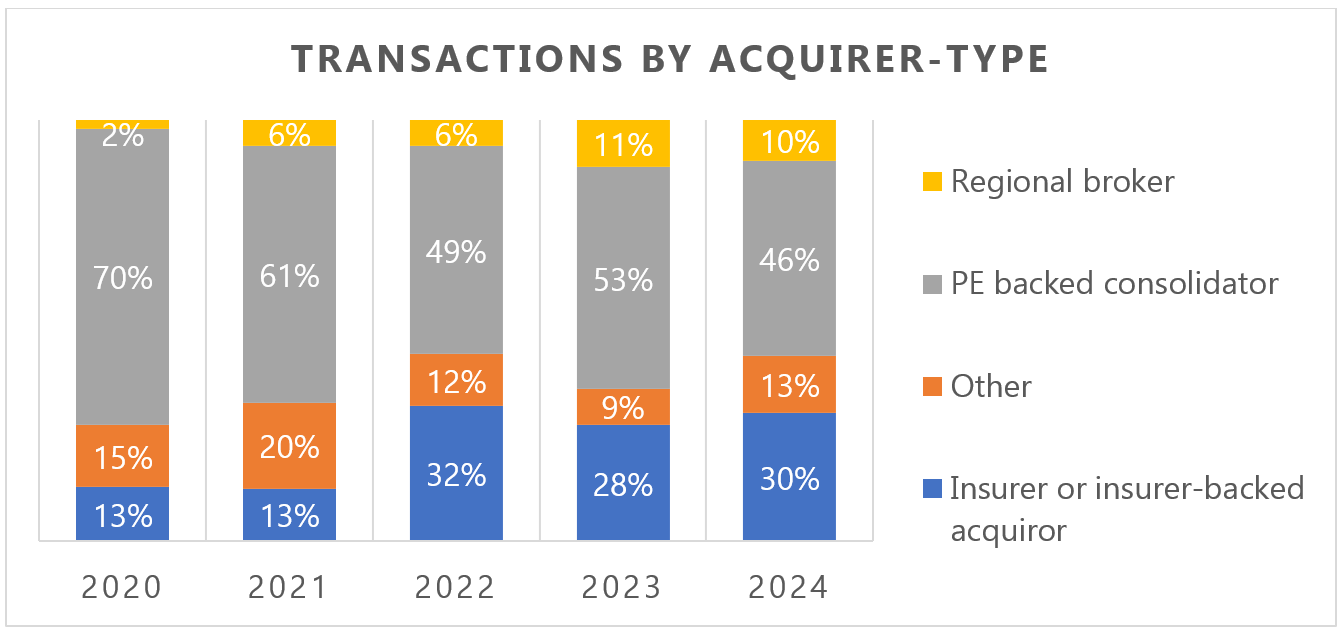

Brokerage M&A Activity by Buyer-type

Keeping in mind consolidators have announced fewer deals publicly, private equity (PE)-backed consolidators and insurer-backed acquirers comprised 77% of announced transaction activity in 2024, which is slightly down from 80% and 81% in 2023 and 2022, respectively. The proportion of transactions completed by PE-backed acquirers has trended downwards since 2020 from a high of 70% to a low of 46% in 2024. However, the number of deals completed by PE-backed consolidators is consistent in 2020 vs. 2024, it’s just that there are more deals being completed by other buyer-types.

With consolidators having achieved significant scale (e.g., over $2Bn in premium), it takes larger acquisitions to help move the needle for inorganic growth; PE typically requires outsized growth to generate necessary annual returns, so we expect there may be some significant changes to the PE-backed category. If the PE’s backing these brokerages decide to exit or lean away from their M&A focused growth strategy, the impact on valuation multiples could be significant.

New Private Equity Entrants

Although the insurance brokerage industry has long been a sought-after asset class for PE investors (evidenced by the number of PE-backed consolidators), there has been a low cadence of new PE entrants in the Canadian marketplace in recent years. In 2024, we were regularly contacted by private equity firms and family offices that are looking for a strong entry point into the Canadian insurance distribution space. Further, we’ve been involved with or aware of a few competitive processes that exclusively included PE investors. Suffice to say, for brokerage owners that have scale and leadership-depth, that prefer to not merge with larger competitor, there are interested capital partners available to help fuel growth and provide partial liquidation opportunities.

Mega Deals & Mergers

Aon’s acquisition of NFP from Madison Dearborn Partners, a US-based PE firm. Although NFP predominantly operates in the US, their Canadian operations were part of the transaction. Insiders report that the transaction traded in the high teens (EBITDA multiple), which given the scale of the operation and commercial focus, is not unexpected.

A.J. Gallagher’s acquisition of Assured Partners in November 2024, which is a US-based brokerage with a decentralized model. This transaction traded for 13.5x pro-forma EBITDA. Although Assured Partners is exclusively operating in the US, valuation multiples have historically been comparable in both markets. With Gallagher’s trading above 20x EBITDA, this is an extremely accretive acquisition. Although the lower than expected multiple won’t reset valuations, it might be an early sign/trend of the frothiness disappearing from the market.

We’re also seeing large, regional brokerages, such as Cal LeGrow Insurance and MacLeod Lorway in Atlantic Canada, merge together to achieve scale and synergies to better compete with national competitors. Smaller brokerages merging together is not a new strategy, and we expect to see more of this activity in 2025.

Key Observations

We’ve observed the following trends during the transactions we’ve been involved with in 2025:

- Valuation multiples are increasingly driven by EBITDA, however revenue multiples are still quoted as a floor value when brokerages have lower-than-average profitability. That being said, this is mostly the case when an acquirer believes an acquisition target’s cost-structure can be improved. We are seeing EBITDA multiples ranging from the low double digits on the low-end of the range to the mid-high teens on the high end, which has translated into revenue multiples exceeding 6x for highly profitable brokerages.

- Acquirers have become more focused and have moved away from the “shotgun” approach to M&A, and instead are doubling-down on the areas of their business that they perform well or already have a competitive advantage.

- Commercial focused brokerages, or those with high-net-worth clientele continue to be high in demand. There is still a market for pure-play retail personal lines brokerages, however scale is more important for comparable valuation metrics.

- A brokerage with strong retention and growing PIF/client count are commanding exceptional valuation multiples.

- The availability of quality data, especially with regard to client profiles and sales funnels, can highlight strengths and alleviate concerns over risks of business continuity. Brokerages that are intentional with their systems and processes can better support the growth opportunities available.

- Due diligence has intensified, therefore pre-sale preparation is becoming more important for sellers in order to maintain deal momentum and maximize value.

- For niche insurance product offerings or program business, acquirer interest will depend on the growth opportunities, and their ability to cultivate and support that growth.

- Acquirers have become increasingly selective, even passing on certain opportunities but being very aggressive on others. This is primarily driven by class of business focus or geography.

- Size has become important, with many acquirers now implementing minimum premium thresholds for brokerages they will consider acquiring. All else being equal, the larger the brokerage, the higher the demand and valuation.

- Competitive sales processes (i.e., a bidding war) continue to result in significantly higher pricing and more seller-friendly terms compared to those sold in one-on-one direct processes. In some cases, there can be a difference of over 40% in pricing.

- Certain acquirers are willing to pay a “strategic premium,” meaning they have an internal rationale to pay an outsized multiple (e.g., geographic or product line expansion). For this reason, from a maximization of shareholder value perspective, it’s to a sellers’ advantage to engage in a competitive sales process.

- Especially for personal lines focused brokerages, unsustainably high contingent profit commissions have returned to pre-pandemic levels. In combination with increased operating costs and softening market conditions, profit margins were slightly compressed.

- Business continuity and retention of key producers, and ultimately clients, is a critical factor in pricing. If you own a brokerage and are also the key producer, provided that you are further away from retirement, there is an expectation of a significant equity roll. For sellers who are the key producers and who are also near retirement age, there’s a higher perceived risk of client retention, which can impact pricing.

- With the decline of interest rates in 2024, acquirers appear to be less concerned than they were at this point last year with their balance sheet and capital structure. We expect that valuations will remain steady while there is still a surplus of capital and scarcity amongst available quality brokerages.

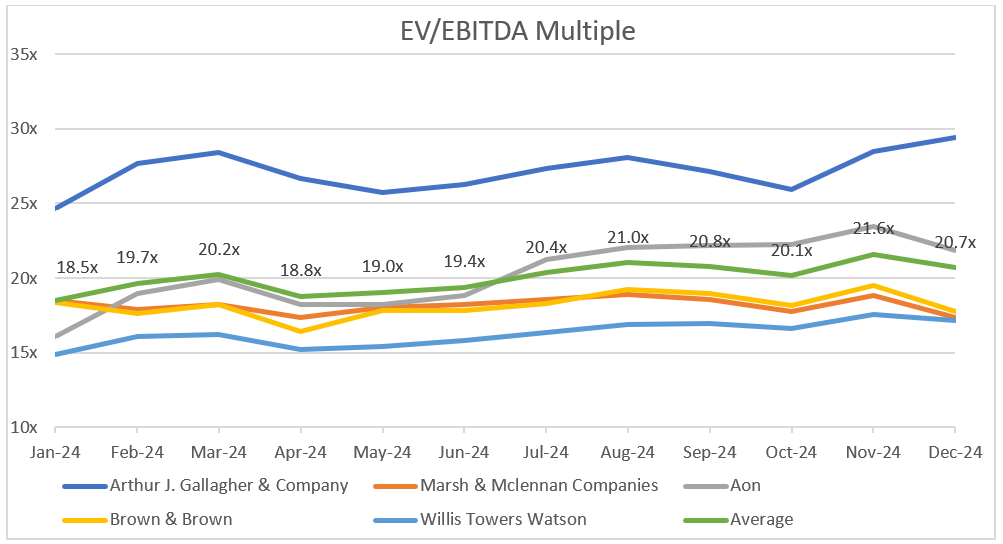

Public broker EV/EBITDA multiples

The following table presents the EBITDA multiples for publicly traded brokerages. The average multiple steadily increased from a low of 18.5x in January to over 20x in Q4. Given the liquidity offered by public markets, multiples for well-run publicly traded brokerages are expected to be higher than their privately held counterparts, however the overall trends can be comparable on average.

If you have any inquiries or require further information regarding brokerage mergers and acquisitions or valuation matters, please don’t hesitate to reach out.