Canadian Insurance Brokerage Industry Update

The first half of 2024 is marked by a steady set of announcements for M&A activity across the Canadian insurance brokerage industry. With renewed market sentiment and general optimism, we expect that the second half of 2024 will ramp up and possibly become another banner year.

Latest Update

While softer than the peak of 2023, the first half of 2024 is proving to be an active year for mergers and acquisitions (M&A) in the insurance brokerage space. With inflation coming under control, the general consensus that Canada will avoid a recession, and the first interest rate cut in June, hesitation amongst acquirers from confidently pulling the trigger on an acquisition has softened. The insurance brokerage industry continues to be a sought-after asset class for investors as it offers resilience in difficult economic periods and frothiness in rising markets. This, coupled with the availability of capital looking for reliable returns, has resulted in a scarcity premium to the benefit of brokerage valuation.

Furthermore, the Federal Budget announcement on April 16th signaled an increase to capital gains inclusion rates effective June 25th, 2024. This drove many brokerage owners contemplating a sale for several months to accelerate their sales plans to beat this deadline. Fortunately, some relief was offered with the ability to crystallize capital gains under the pre-June 25th rules so that owners could consider their succession plans thoughtfully.

During the first half of 2024, we observed 48 publicly announced transactions in the Canadian brokerage M&A market across property and casualty, life and group health brokerages. Deal volume in the first half of 2024 was comparable to the same periods in 2023 with 52 transactions and 2022 with 42 transactions, which remain elevated since the pandemic

Canadian Underwriter’s 2024 annual National Broker Survey reported results that resonate with many of our clients, that although the preferred option is to keep the brokerage in the family or sell to management, given current valuation multiples driven by M&A, financing an internal succession plan just isn’t practical. With the challenges of running a smaller independent operation, and succession planning and retirement at the forefront for many brokerage owners, we expect M&A activity to remain steady in 2024.

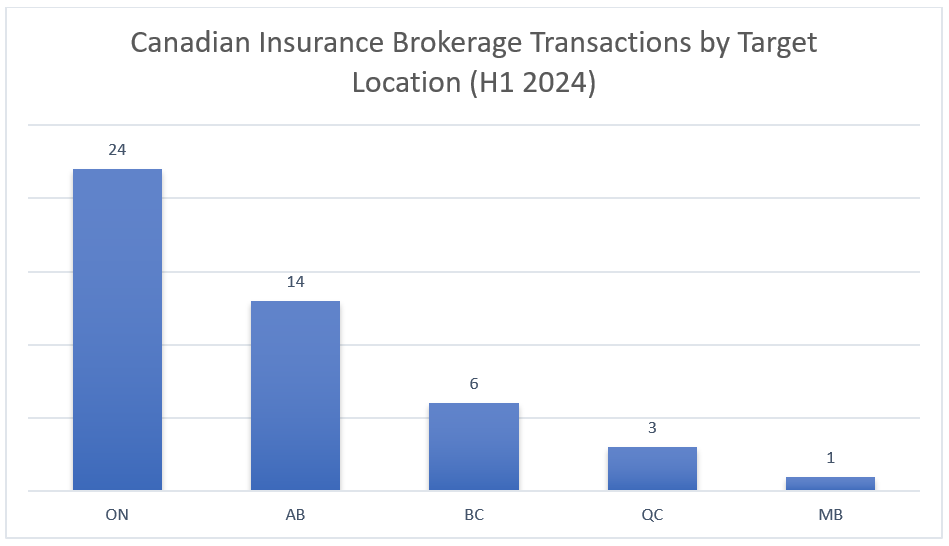

Geographic Breakdown

The provinces of Ontario and Alberta continue to represent the largest proportion of M&A activity in Canada in 2024 as in previous years. As expected, the demand for retail brokerages in provinces with public auto insurance remains weaker, with exceptions made for brokerages with a strong commercial book of business or scale. The decreased interest in public auto environments is also reflected in the flat market value of standalone auto licenses in certain provinces.

Major Players in Brokerage M&A

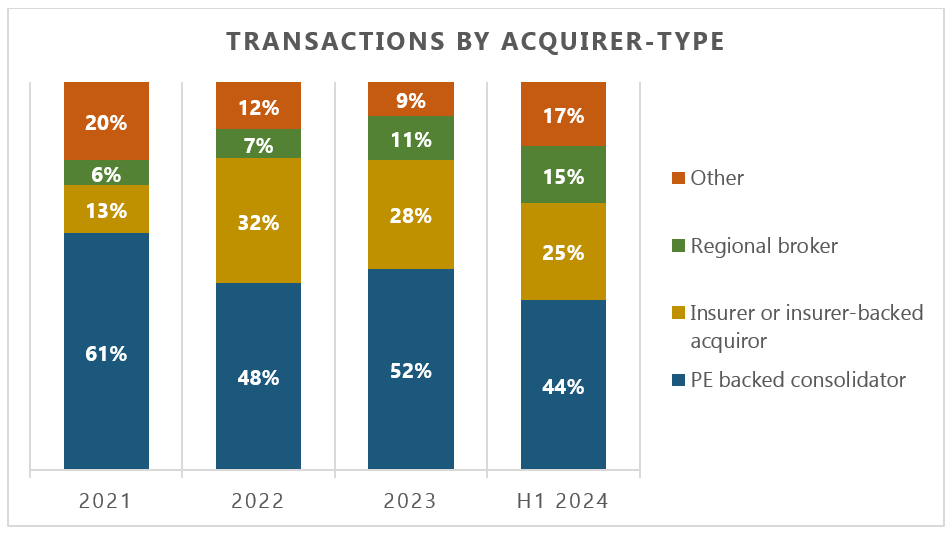

Private equity-backed consolidators and insurer-backed acquirers comprised 69% of announced transaction activity in H1 2024, which is down from 80% in both 2022 and 2023 overall. This is primarily due to an uptick in direct investments by private equity (as opposed to private-equity backed consolidators) as well as public broker acquisitions. We expect that H2 2024 will balance out this trend and result in a return to 2022 and 2023 ratios.

Key Observations

We’ve observed the following trends during the transactions we’ve been involved with so far this year:

- Acquirers are increasing their focus on brokerages with real organic growth (i.e., increase in PIF or client count) over and above rate increases, as the industry enters softer market conditions. Brokerages that demonstrate a consistent level of new client growth command exceptionally high valuation multiples. For niche insurance product offerings or program business, acquirer interest will depend on the growth opportunities, and their ability to cultivate and support that growth.

- Due to scarcity, overall insurance brokerage valuation has trended upwards across all brokerage sizes, however acquirers vary in appetite for size and class of business.

- Certain acquirers are willing to pay a “strategic premium”, meaning they have an internal rationale to pay an outsized multiple (e.g., geographic or product line expansion). For this reason, from a maximization of shareholder value perspective, it’s to a sellers advantage to engage in a competitive sales process.

- For some brokers, there is a return to regular pre-COVID loss ratios that have eroded the significant contingent profit commission received as a result of the pandemic. In combination with increased operating costs and softening market conditions, brokerage profitability is expected to decline temporarily.

- Cost increases due to inflation have stabilized, and although there is still a war for talent, brokerages are no longer in desperation mode, having to offer significant increases in compensation to hire or retain staff.

- Business continuity and retention of key producers, and ultimately clients, is a critical factor in pricing. For sellers that are further away from retirement age and who are the key producer, there is an expectation of a significant equity roll and market compensation. For sellers that are the key producer and who are also near retirement age, there’s a higher perceived risk of client retention, which can impact pricing.

- Consolidators continue to expand the scope of their acquisition strategies, demonstrating a noticeable increase in acquiring life and group health entities, securing claims management talent, and engaging in additional services within the same business vertical.

- Acquirers have become more selective about brokerages they will acquire, with B2B focused brokerages in high demand. There is still a market for traditional, personal-lines focused brokerages, particularly those with scale or a concentration of high-net-worth clientele. It’s important for any brokerage to demonstrate strong retention and growing PIF count in order to maximize value.

- With the expectation that interest rates will continue to go down, acquirers appear to be less concerned than they were at this point last year with their balance sheet and capital structure. We expect that valuations will remain steady while there is still a surplus of capital and scarcity amongst available quality brokerages.

- Competitive sales processes (i.e., a bidding war) continue to result in significantly higher pricing and more seller-friendly terms compared to those sold in one-on-one direct processes. In some cases, there can be a difference of over 40% in pricing.

- Valuation multiples are increasingly driven by EBITDA, however revenue multiples are still quoted as a floor value when brokerages have lower-than-average profitability. That being said, this is mostly the case when an acquirer believes an acquisition target’s cost-structure can be improved. We are seeing EBITDA multiples ranging from the low double digits on the low-end of the range to the mid-high teens on the high end, which has translated into revenue multiples exceeding 6x for highly profitable brokerages.

- The availability of quality data, especially with regards to client profiles and sales funnels, can highlight strengths and alleviate concerns over risks of business continuity. Brokerages that are intentional with their systems and processes can better support the growth opportunities available.

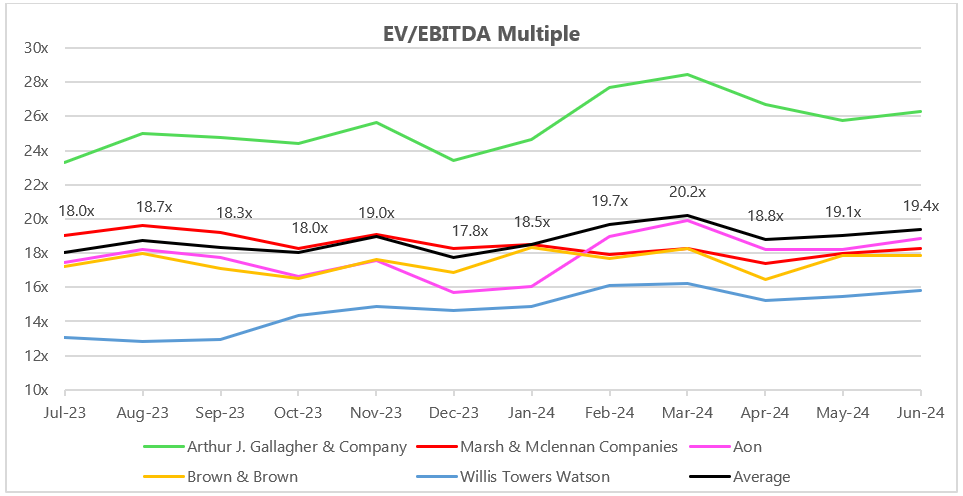

Public broker EV/EBITDA multiples

If you have any inquiries or require further information regarding brokerage mergers and acquisitions or valuation matters, please don’t hesitate to reach out.