M&A Frenzy Continues: Canadian Insurance Brokerage Industry Update

Canadian insurance brokerage M&A activity has been steadily increasing for the past decade, and 2023 is shaping up to be another record-setting year. This article will delve into the key trends, observations, and notable transactions that have defined brokerage M&A in 2023.

Latest Update

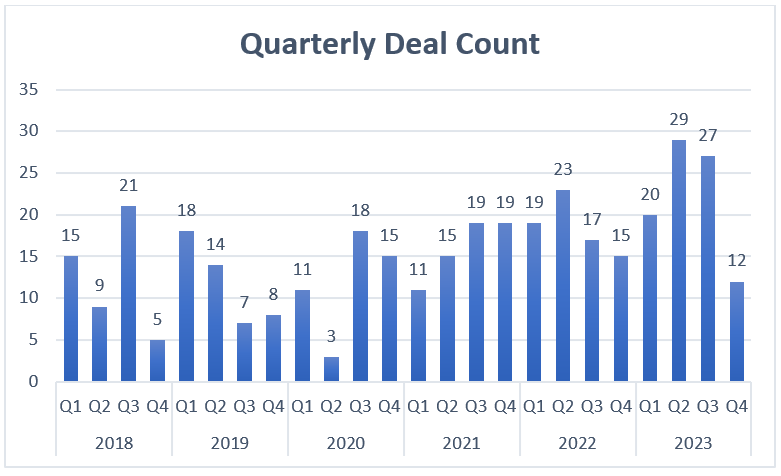

As of the end of October 2023, there have been 88 publicly announced insurance brokerage transactions (including life and group health brokerages acquired by P&C consolidators), with 72 of them focused on property and casualty targets. This trend represents at least a continuation of the uptick in activity in this space since 2020, with 74 publicly announced deals in 2022 and 64 in 2021.

* Q4 2023 only includes October transactions.The pace of M&A deals slowed in the transition from late 2022 to Q1 of 2023. We attribute this slowdown to acquirers adapting to the new “higher for longer” interest-rate environment, especially those heavily leveraged. Since then, the number of closed deals in Q2 and Q3 of 2023 has surpassed any previous quarter since 2018. We expect the number of transactions will continue to rise as acquirer appetite remains robust, and the number of brokerage owners looking to exit their business due to retirement considerations is increasing.

Geographic Breakdown

The provinces of Ontario and Alberta represent the largest proportion of M&A activity in Canada. The demand for retail brokerages in provinces with public auto insurance remains weaker, with exceptions made for brokerages with a strong commercial book of business or scale.

Major Players in Brokerage M&A

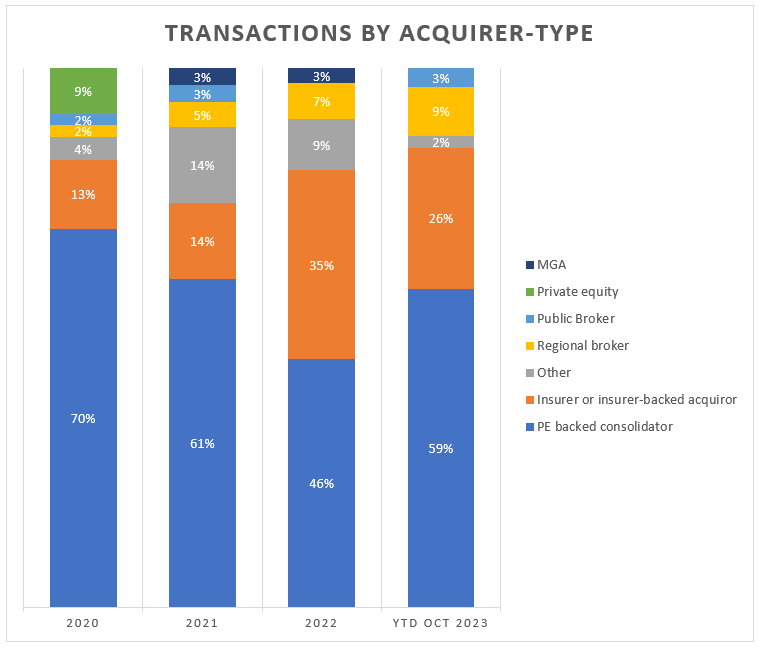

Private equity-backed consolidators have continued to dominate M&A activity, being responsible for 59% of acquisitions thus far in 2023. While insurer-backed acquisition activity surged in 2022, PE-backed firms remain the driving force behind consolidation over the past decade.

Several high-profile transactions have marked 2023, including the Ontario Teachers’ Pension Plan’s investment in Westland Insurance Group Ltd. via Broadstreet Partners, Madison Dearborn Partners’ follow-on investment in Navacord Corp., Leonard Green & Partners, L.P.’s investment in Hub International Limited (with an enterprise value of $23 billion), and Definity’s acquisition of Drayden Insurance (with an enterprise value of $208 million). Several of these transactions were to bolster balance sheets to enter a new phase of acquisition activity.

Key Observations

We’ve observed the following trends based on the 10+ transactions we’ve been involved with this year:

- P&C consolidators continue to diversify their acquisition theses, with a notable uptick in the number of life and group health acquisitions, claims management acqui-hires and other services in the vertical.

- That being said, buyers are being more selective about the brokerages they will pursue, with an increase in demand for commercial lines-focused brokerages with a specialization or program business, above-average organic growth, youthful expertise (“acqui-hire”) and specific geographic considerations. There is still a strong market for traditional, personal-lines focused brokerages, however there is unequal demand amongst the usual acquirers.

- With an increase in the cost of capital, certain acquirers have slowed down their pace of acquisition, however this is dependent on their existing cash flow, leverage and cost of capital.

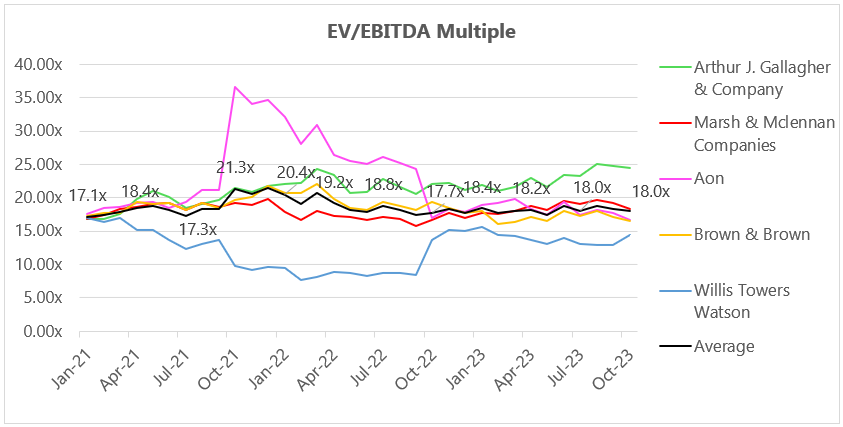

- Although certain acquirers have slowed down, overall M&A activity and valuation multiples remain resilient, and in some cases have increased for brokerages represented in competitive sales processes (i.e., a bidding war), compared to those sold in a one-on-one direct process.

- Valuation multiples are increasingly driven by EBITDA, however revenue multiples are still quoted as a floor value when brokerages have lower-than-average profitability. That being said, this is mostly the case when an acquirer believes an acquisition target’s cost-structure can be improved. We are seeing EBITDA multiples ranging from 10x on the low-end of the range to over 15x on the high end, which has translated into revenue multiples exceeding 6x for highly profitable brokerages.

- Deal-structure has continued to evolve, with an increased use of share consideration vs. all-cash deals. Prior to the new debt environment, share consideration was primarily used for retention and management purposes, however it is now also being used as a financing tool.

- Sellers are becoming more aware of the pros and cons of merging with the different types of acquirers, and are therefore being more thoughtful about who and when to exit their brokerages.

- Internal succession plans (i.e., selling to employees or the next generation) have become more challenging now compared to years prior given that valuations are unchanged even in a much higher cost of capital environment.

Public broker EV/EBITDA multiples

If you have any inquiries or require further information regarding brokerage mergers and acquisitions or valuation matters, please don’t hesitate to reach out.