New Reporting Rules for Trusts Starting 2023

Update: This article was originally published on March 4, 2022, and has been updated to reflect the new date on which the rules will be effective. The implementation delay was announced by the federal government in the Fall Economic Statement presented on November 3, 2022. Consequently, these trust reporting rules will now apply to taxation years ending after December 30, 2023.

Currently, certain inactive trusts are exempt from filing a trust return (T3 Return). However, for taxation years ending on or after December 31, 2023, new reporting requirements will apply for trusts. The changes are meant to improve the collection of beneficial ownership information with respect to trusts and to help the Canada Revenue Agency (CRA) assess the tax liability of trusts and their beneficiaries. The budget also proposed penalties for non-compliance with the new requirements.

Expanding Filing Requirements

Canadian resident “express trusts” (generally a trust created with a settlor’s express intent, as opposed to a resulting trust, during his/her lifetime or at death through a will) will be required to file an annual T3 Return, even where one is not currently required. This expanded filing requirement will impact most standard family trusts settled as part of an estate freeze and those settled to hold recreational property. On February 4, 2022, draft legislation was released that further expands this filing requirement to include bare trusts.

New Information Reporting

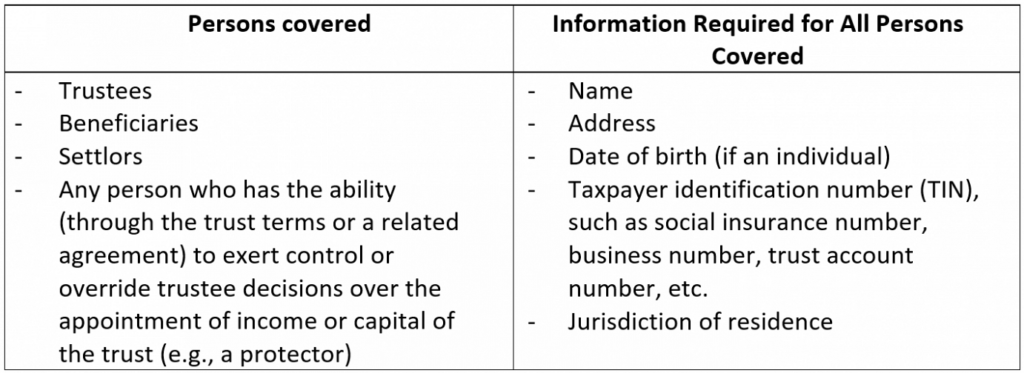

All non-resident trusts that are currently required to file a T3 Return and Canadian resident express trusts (other than exceptions listed below) will be required to report the following information on a new schedule, to be filed along with the T3 Return each year:

Exceptions

The new rules do not apply to trusts that are not express trusts and certain express trusts. The following is a select list of express trusts not subject to the new rules:

- Trusts that have been in existence for less than three months;

- Trusts that hold assets with under $50,000 in fair market value throughout the taxation year (provided the assets are limited to cash, certain government debt obligations, certain listed securities and debt, and mutual fund shares/units);

- Trusts governed by registered plans (including RRSPs, RESPs and TFSAs);

- Graduated rate estates;

- Qualified disability trusts;

- Lawyers’ general trust accounts;

- Trusts that qualify as non-profit organizations or registered charities; and

- Employee life and health trusts.

Penalties

Failure to file the T3 Return, including the new schedule of additional information, will lead to the standard penalty of $25 per day (minimum penalty of $100) with a maximum penalty of $2,500. An additional gross negligence penalty of 5% of the highest total fair market value of all the property held by the trust in that year (minimum penalty of $2,500) may also apply.

Next Steps

Trusts that may not have been required to file tax returns in the past will likely be required to file one annually beginning in 2023. Although the earliest filing deadline under these new rules is a year away (March 31, 2024 for trusts with taxation years ending on December 31, 2023), trustees should begin gathering information needed to comply with these new rules, as the additional information required may not be readily available.

Please consult your Smythe advisor with any questions about the new reporting rules.