Recent Transactions

Snapshot of transactions that Smythe’s advisory team has recently consulted on, and has helped close successfully. If you have similar needs, reach out to our advisors today.

Valuation of a Pizza Chain

Smythe’s advisory team calculated the fair market value of a group of five companies for tax planning purposes.

EBITDA Analysis for an SaaS Company

Smythe’s advisory team prepared a schedule of normalized EBITDA to assist a client in divestiture negotiations.

Valuation of a Concrete Supplier

Smythe’s advisory team estimated the value of a family-owned concrete business for tax reorganization purposes.

Sale of King Insurance Ltd. to Westland Insurance Group Ltd.

Smythe Advisory acted as the exclusive divestiture advisors to King Insurance Ltd., a Manitoba-based insurance brokerage, in its sale to Westland Insurance Group Ltd.

Sale of Elevate Insurance Brokers to Hub International Canada West ULC

Smythe Advisory acted as the exclusive divestiture advisors for Elevate Insurance Brokers, an Alberta-based insurance brokerage, for its sale to HUB International Canada West ULC.

Valuation of a Tool & Hardware Distribution Business

Smythe’s advisory team prepared a valuation of a business division for possible carve-out transaction.

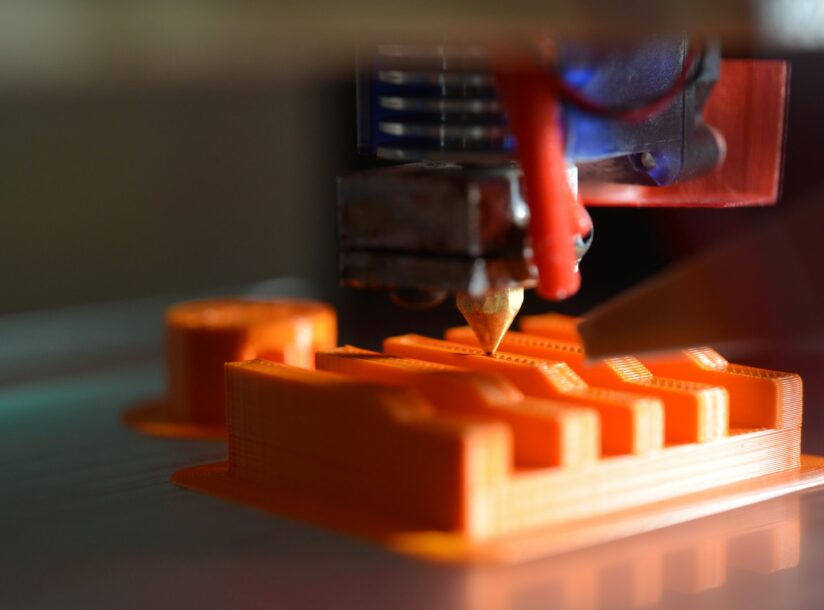

Valuation of a 3D Printing Company

Smythe’s advisory team estimated the fair value of our client’s investment in a 3D printing technology company for financial reporting purposes.

SALE OF WAINWRIGHT MARINE SERVICES LTD. TO STRATEGIC BUYER

Smythe Advisory represented the shareholders of Wainwright Marine Services Ltd. in the divestiture of their Company to a strategic buyer.

VALUATION OF A FILM SCHOOL

We were jointly retained by the shareholders to estimate the fair market value of the Company’s shares for a possible buy-out of a 50% interest.

SALE OF FOOD DISTRIBUTOR TO A FINANCIAL PURCHASER

Transaction advisor to the shareholders of a food distribution company in its sale to a financial purchaser.

SALE OF WAYPOINT INSURANCE SERVICES INC. TO NAVACORD CORP.

Smythe Advisory acted as the exclusive financial advisors to Waypoint Insurance Services Inc. in the divestiture of their business to Navacord Corp.