Matrimonial Separation – Process and Importance of Tax Planning

Matrimonial separation in Canada involves several structured steps aimed at ensuring fair and equitable treatment of both parties. The process starts with the decision to separate, followed by obtaining legal advice, negotiating and drafting a separation agreement, and addressing issues related to children, support, and property.

The detailed steps are:

- Decide to Separate

- Consult Legal Advice

- Draft a Separation Agreement

- File for Separation

- Child Custody and Support Arrangements

- Spousal Support

- Division of Property and Debts

- Court Proceedings (if necessary)

- Finalizing the Divorce (if applicable)

In this article, we are going to discuss the division of property and debts during a matrimonial separation, its tax implications with or without a tax planning in place, how to turn a property into a business if not occupying it as a principal residence and run it post separation to maximize the benefit of the property receiver.

The division of property and debts upon matrimonial separation is governed by provincial family law legislation, rather than federal law. Each province and territory has its own set of rules and guidelines for the division of property and debts, yet the following are some common principles across jurisdictions.

- Equalization of Net Family Property (NFP):

- Many provinces, including British Columbia and Ontario, follow the principle of equalization of NFP. This means that upon the breakdown of a marriage, the spouses are entitled to an equal share of the increase in the value of their property acquired during the marriage, subject to certain exceptions.

- Net Family Property typically includes assets such as real estate, investments, pensions, businesses, vehicles, and personal property, minus debts and liabilities.

- Each spouse calculates their NFP by subtracting their debts and liabilities from the value of their assets, as of the valuation date (usually the date of separation).

- The spouse with the higher NFP owes an equalization payment to the spouse with the lower NFP to achieve an equal division of assets.

- Excluded Property:

- Not all property is subject to equalization. Certain types of property may be excluded from the NFP calculation, such as gifts, inheritances, and property owned before the marriage, as long as they have been kept separate from marital assets.

- For example, if one spouse received an inheritance during the marriage and kept it separate from marital assets, it may be excluded from the equalization calculation.

- Matrimonial Home:

- The matrimonial home is often treated differently from other assets. In many provinces, it is given special consideration due to its significance as a family residence.

- Depending on the jurisdiction, one spouse may be entitled to exclusive possession of the matrimonial home for a certain period, or it may be sold, and the proceeds be divided between the spouses.

- Debts and Liabilities:

- Debts and liabilities acquired during the marriage are typically included in the equalization calculation.

- Common examples of marital debts may include mortgages, car loans, credit card debt, and lines of credit.

- Each spouse may be responsible for debts they incurred individually, as well as joint debts, unless otherwise specified in a separation agreement or court order.

- Division of Debts:

- Debts are usually divided between the spouses in a manner that is fair and equitable, taking into account factors such as the purpose of the debt and the financial circumstances of each spouse.

- For example, if one spouse incurred a significant debt for educational purposes during the marriage, the other spouse may be required to contribute to its repayment, particularly if it benefited the family as a whole.

In our forthcoming discussion, we will primarily focus on property matters and set aside the discussion of debts in this article.

During a matrimonial separation, various types of property may need to be considered for division between the spouses. Here are some key categories of property items:

- Real Estate

- Financial Assets

- Personal Property

- Pensions and Retirement Benefits

- Business Assets

- Other Assets

Real Estate

For Real Estate, the matrimonial home is often the most significant asset to be divided. This includes the family residence where the spouses lived together during the marriage. Other real estate properties such as vacation homes, rental properties, or undeveloped land may also need to be addressed.

In order to defer tax liabilities associated with the transfer of property, Subsection 73(1) – Rollover of Property to Spouse or Common-law Partner can play a key role in tax planning for both parties.

Benefits of Subsection 73(1) in Matrimonial Separation include the following:

- Immediate Tax Deferral

- One of the most significant benefits is the deferral of capital gains tax. When property is transferred at its adjusted cost base (ACB), the transferring spouse does not have to pay capital gains tax at the time of the transfer. Instead, the tax liability is deferred until the receiving spouse disposes of the property in the future. This can help both parties avoid a substantial tax bill during an already financially and emotionally challenging time.

- Financial Flexibility

- By deferring tax liabilities, both spouses can maintain greater financial flexibility. Immediate capital gains tax can significantly reduce the liquidity available to either party, complicating the division of assets and financial planning. Deferred tax allows for smoother asset distribution and better cash flow management.

- Simplified Asset Division

- The use of the rollover provision simplifies the division of marital assets. Without the immediate tax burden, spouses can negotiate asset transfers more freely, focusing on equitable distribution without the pressure of upfront tax costs. This can lead to more amicable settlements and reduce the likelihood of prolonged legal disputes.

- Continuity of Ownership

- The spousal rollover allows for the continuity of property ownership within the family. This is particularly beneficial if the property has sentimental value, such as a family home, or strategic importance, such as a business asset. The receiving spouse can continue to use or benefit from the property without the immediate financial strain of capital gains tax.

- Future Tax Planning Opportunities

- Deferring the tax liability provides opportunities for future tax planning. The receiving spouse can manage the timing of the eventual sale of the property to coincide with a period of lower income or higher available deductions, potentially reducing the overall tax burden.

Practical Examples

Scenario 1: During their matrimonial separation, Smith and Anna decide to transfer the family home to Anna. The home was purchased for $300,000 (ACB) and is now worth $600,000 (FMV).

- Without Subsection 73(1): If the property is transferred at FMV, Smith would realize a capital gain of $300,000 ($600,000 – $300,000). Assuming a 25% capital gains tax rate, Smith would owe $75,000 in capital gains tax (Principal residence could be exempt.)

- With Subsection 73(1): Using the spousal rollover provision, the property is transferred to Anna at the ACB of $300,000. No capital gain is realized at the time of transfer, deferring the $75,000 capital gains tax. Anna assumes the ACB of $300,000, and the tax liability is deferred until she sells the property.

Option one: For Anna (the receiving spouse), if the family home is used for principal residence, the spousal rollover provision can be naturally applied. There is no tax payable for both parties.

Option two: If Anna already has a principal residence and doesn’t need to live in this family home, instead, she prefers to turn it into a rental property to generate future rental income and eventually dispose the property at a fair market value at a later time. She can make an election to receive the family home at the fair market value of $600,000. After 3 years, if she sells the property for$800,000 to a third party, the capital gain will be only $200,000 rather than $500,000, leading to substantial tax savings. Meanwhile, in the year of separation, although the property is elected to be disposed at FMV of $600,000, Smith doesn’t need to pay any tax due to the family home being the principal residence.

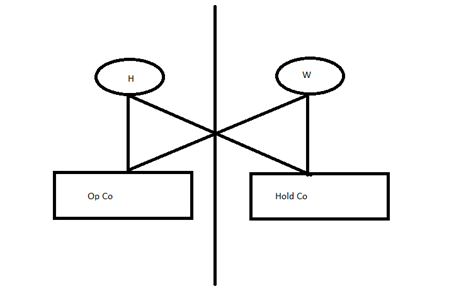

Scenario 2: Anna and Smith are getting a divorce. They jointly own two companies:

- Operating Company (Op Co)

- Total value: $1,000,000

- Anna owns 50% of the operating company.

- Smith owns 50% of the operating company.

- Holding Company (Hold Co)

- Total value: $500,000

- Anna owns 50% of the holding company.

- Smith owns 50% of the holding company.

They have agreed that Smith will continue to run Op Co., while Anna will own the shares of Hold Co.

Steps to Divide Business Assets:

- Valuation of Businesses:

- Operating Company (Op Co) value: $1,000,000

- Holding Company (Hold Co) value: $500,000

- Individual Shares:

- Operating Company (Op Co):

- Anna’s share: 50% of $1,000,000 = $500,000

- Smith’s share: 50% of $1,000,000 = $500,000

- Holding Company (Hold Co):

- Anna’s share: 50% of $500,000 = $250,000

- Smith’s share: 50% of $500,000 = $250,000

- Operating Company (Op Co):

- Agreement on Asset Division:

- Anna agrees to transfer her 50% shares of Op Co to Smith.

- Smith agrees to transfer his 50% shares of Hold Co to Anna.

- Tax on Share Transfers:

- Without any tax planning, Smith would incur tax on disposition of Hold Co shares of $62,500 (assuming 25% tax rate: $250,000 x 25%).

- Without any tax planning, Anna would incur tax on disposition of Op Co shares of $125,000 (assuming 25% tax rate: $500,000 x 25%)

- Tax liability would form a debt of the NFT, however if not identified prior to finalization of the divorce, each spouse may be responsible for their own tax debt which may not be considered as part of the equalization payment between spouses.

- Tax planning may allow for reduction and/or deferral of the tax.

- There may be an option for each spouse to incorporate a new holding company and roll their respective shares into this new holding company on a tax deferred basis, thus triggering no tax on the transfer of shares between spouses.

- Financial Settlement:

- Smith needs to compensate Anna for the difference in the value of companies they’ll each receive, being $250,000, depending on tax liabilities ($1,000,000 – $500,000 / 2).

- Settlement Options:

- Lump-Sum Payment: Smith pays Anna $250,000 in a lump-sum payment.

- Installment Payments: Smith pays Anna $250,000 over an agreed period, such as $50,000 per year for five years (this type of payment plan may work well with certain tax planning to reduce tax).

- Asset Transfer: Smith may transfer other marital assets equivalent to $250,000 to Anna. This could include properties, investments, or other valuable items they jointly own.

- Legal Documentation:

- They would formalize this agreement through legal documentation, ensuring that the transfers of shares are done legally.

- Both parties might consult with their respective lawyers to draft the agreements and ensure they comply with local laws.

In summary, matrimonial separation demands a strategic approach to business valuation, tax implications, and future management. Engaging professional advisors, including business valuators, tax experts, and legal counsel, can facilitate a smoother transition and ensure that both parties are financially secure post-separation. By understanding and planning for the potential tax outcomes, separating couples can make informed decisions that preserve the value of their business and personal assets.