Mergers and Acquisitions: 2023 Year in Review

As we look ahead to what’s in store for 2024, let’s first look back at our predictions for this past year. Coming off record breaking M&A activity in 2021 fueled by a historically low-interest rate environment, deal activity in the latter half of 2022 started slowing down as the Bank of Canada began increasing interest rates to battle inflation. Faced with an economic backdrop with many economists talking about an inevitable recession, the predictions we made at the beginning of 2023 included:

- Caution in Valuations and Deal Activity: We foresaw a cautious approach, warning against expecting a return to the robust valuations and deal activity witnessed in 2021.

- Resilience in Recession-Proof Sectors: Despite predicting a slow overall deal market, we predicted that transactions within recession-resilient sectors would maintain their activity levels. There was still a significant amount of capital looking for opportunities.

- Motivated Sellers Bridging Valuation Gaps: We anticipated that motivated sellers would find innovative ways to bridge valuation gaps, highlighting the adaptability of deal-making strategies. On the other hand, we predicted that other sellers may decide to wait for a more optimistic M&A climate.

- Selective Purchasers and Financing Challenges: We predicted that purchasers would become more selective, resulting in fewer offers at the high end of the valuation range. Financing challenges were expected to increase, influencing the prevalence of earn-outs and vendor financing structures.

- Interest Rate Trends: We expected that the Bank of Canada would slow down its interest rate increases to allow the market to adjust to the rapid hikes in 2022.

Representing both buyers and sellers, Smythe advised on 12 successful transactions in 2023. Looking at the trends from the deals that we worked on, many of our predictions came true:

- Strong Demand in Stable Industries: Several of our deals were in the insurance industry, which is recession-proof and marked by steady, stable cash flows. Despite the high interest rate environment, we saw multiple offers and record high valuations on these transactions.

- Shift to a Buyer’s Market: For businesses outside of the “in-demand” industries, we saw a decline in demand as the year progressed. While we still saw a few all cash offers, the vast majority included earnouts and vendor financing. To get deals done, motivated sellers were willing to take lower multiples than they would have received in 2021 or 2022.

- Increased Selectiveness: Across all industries, including recession-proof ones, we saw increased selectiveness amongst buyers. Buyers had their investment criteria and they were disciplined to pass on opportunities that didn’t meet it. Financial buyers weren’t willing to take unnecessary risks on deals outside of their comfort zone. Strategic buyers were only looking at deals that complimented their business strategy. Higher risk businesses, such as ones heavily reliant on project-based work or early-stage companies, had trouble finding willing investors.

- Impact of High Interest Rates: Debt servicing abilities became a significant issue. Buyers who were relying on leverage could not compete on deals against well-capitalized purchasers. On the other hand, sellers faced potential repricing on deals once buyers received term sheets from lenders and realized they couldn’t service the debt.

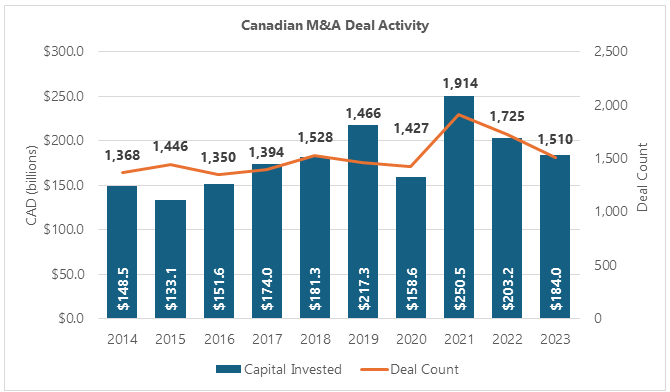

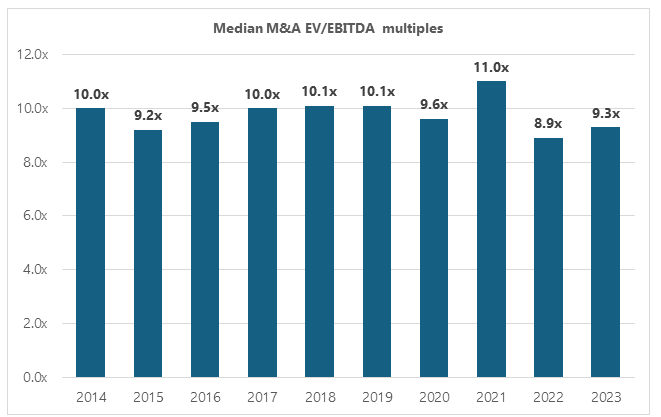

The trends that we observed are consistent with the data that we have seen on the general Canadian M&A market. While deal volume is comparable to pre-COVID levels, diminished valuation multiples have led to a decrease in invested capital. The charts below provide an overview of M&A activity, encompassing deal count, invested capital, and median EV/EBITDA multiples over the past decade.

Looking ahead to 2024, there is cautious optimism that M&A activity will rebound from 2023 with anticipated interest rate cuts at some point during the year. However, we still predict that buyers will continue to be selective in choosing which opportunities to pursue. Strong businesses that saw a dip in valuations due to general market conditions will see valuations bounce-back as the market improves, but businesses that are off-strategy for investors will continue to see little interest. B2B businesses will lead the pack for M&A activity, while B2C businesses will struggle as consumers continue to face cost of living pressures.

If you are looking to purchase or sell a business or would like to discuss the observations made within this article, please contact a member of our team.

Reach Out

Our Work Select Transactions

Optimum Strategies Inc. Acquired by Navacord Corp.

Smythe Advisory acted as the exclusive divestiture and tax advisors to Optimum Strategies Inc., a B.C.-based brokerage that specializes in providing group benefits and private health service plans, in its sale to Navacord Corp.

Shephard Ashmore Insurance Inc. Acquired by Westland Insurance Group Ltd.

Smythe Advisory acted as the exclusive divestiture advisors to Shephard Ashmore Insurance Inc., one of Canada’s leading music and entertainment specialty insurance brokerages, in its sale to Westland Insurance Group Ltd.

Bedrock Insurance Brokers Inc. Acquired by Axis Insurance Managers Inc.

Smythe Advisory acted as the exclusive divestiture advisors to Bedrock Insurance Brokers Inc, a North York, Ontario based commercial lines focused insurance brokerage, in its sale to Axis Insurance Managers Inc